Mumbai: India’s budget airlines will spearhead the transition to Navi Mumbai Airport, the much-anticipated second airport for the country’s financial capital, developed by billionaire Gautam Adani, as it gears up for a planned May opening.

IndiGo, India’s largest airline, will relocate part of its operations to the new airport, according to people familiar with the matter who requested anonymity as the information is private.

Tata Group’s low-cost carrier Air India Express and smaller rivals SpiceJet and Akasa are also in discussions to eventually relocate all of their operations, the people added.

Air India Ltd.’s full-service carrier will continue to operate from the existing airport for now but will shift more of its domestic operations to Navi Mumbai, about 22 miles southeast of Mumbai’s congested existing aerodrome, the people said.

The Adani Group’s new $2.1 billion airport is a landmark infrastructure project for the sprawling metropolis of 21 million people aimed at reducing aviation bottlenecks and creating an international transit hub similar to Dubai, London or Singapore.

Local authorities plan to build an “aero city” around the new airport to boost non-aviation sources of revenue.

Both the existing Mumbai airport and the new one on the city outskirts are managed by the Adani Group, putting the Indian ports-to-power conglomerate in a strong position as it negotiates with the airlines over moving some of their flights to the new facility.

Representatives for Adani Group, Air India, IndiGo, SpiceJet and Akasa didn’t immediately respond to an emailed request for comments.

The lack of high-speed transportation links to the new facility and between the city’s two airports, especially in a high-traffic metropolis like Mumbai, poses a major challenge for the Adani Group in luring fliers and transit passengers. A metro line between the two airports is being planned but it’s a few years away.

Executives across airlines said discussions with Navi Mumbai airport are focusing on preferable slots and on incentives around airport fees. Incentives are a key issue as they would help the airlines offer attractive fares to passengers, who might otherwise prefer the old airport to the new location due to connectivity issues, the executives said.

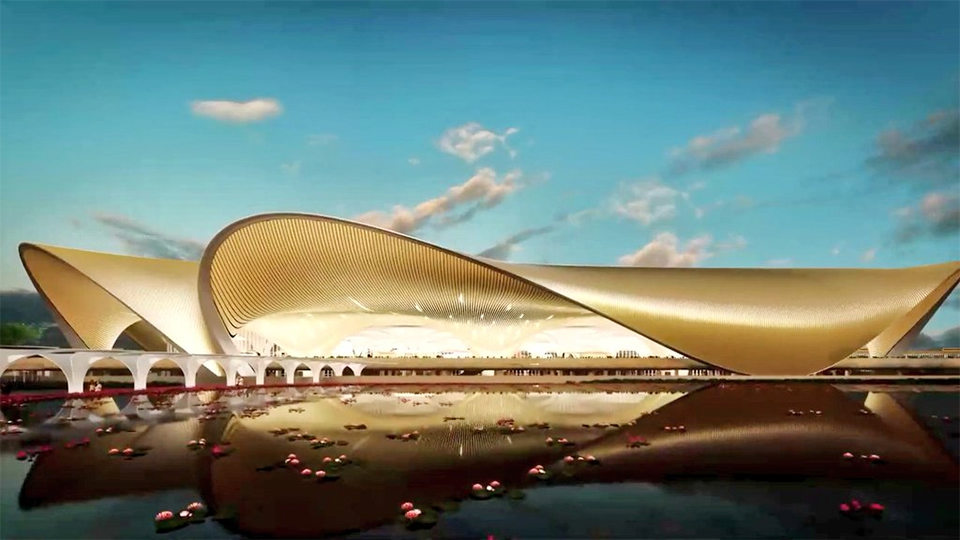

The new airport — with a lotus-shaped building mimicking India’s national flower — will initially operate one terminal with an annual capacity of 20 million passengers, according to one of the people familiar.

If demand is strong, it can be ramped up in phases to handle 90 million passengers through the next decade, they said.

Some airlines have been told to target a shift between April and June for domestic operations with the airport expected to start international flights in August, the people said.

Adani Airports is talking to Star Alliance, the world’s largest network of airlines, including Air India, to shift members’ operations to Navi Mumbai, they added.

-B