Dhaka : India's sudden withdrawal of a crucial cargo transshipment facility has forced Bangladesh to confront a significant logistics challenge. The facility, which since 2020 allowed Bangladeshi exports-primarily readymade garments (RMG)-to transit via Indian land routes to airports and seaports, served as a critical relief channel amid the pandemic and beyond. Now, exporters are scrambling for alternatives.

The route enabled goods to be trucked from Bangladesh to Indian airports like Kolkata and Delhi, from where they were flown to destinations across the globe. This proved invaluable, especially given the ongoing congestion and limited capacity at Dhaka's Hazrat Shahjalal International Airport (HSIA).

Industry data shows around 18 percent of Bangladesh's weekly air exports (about 600 tons of 3,400 tons) were routed through Indian airports. From January 2024 to March 2025, more than 34,900 tons of RMG, worth USD 462.34 million, were exported through India to over 36 ountries, including the US, Germany, France, Japan, and South Korea.

India's decision, citing growing congestion at its own airports and seaports, was unexpected-especially after recent diplomatic interactions bet-ween the two countries aimed at deepening trade ties.

HSIA under pressure: rising costs, delays

With the Indian route now blocked, pressure on Dhaka's HSIA is surging. Exporters are already raising concerns about delays, missed lead times, and logistical chaos.

Cargo build-up could result in pilferage, damage to goods, and storage complications, as HSIA lacks modern cold chain and warehousing facilities, said Syed Ershad Ahmed, President of American Chamber of Commerce in Bangladesh, talking to The Bangladesh Monitor.

Airfreight from Dhaka is already expensive:

(1) USD 6.30-USD 6.50/kg to Europe

(2) USD 7.50-USD 8.00/kg to the USA

(3) Plus, additional charges:

(a) BDT 2.5/kg for ground handling

(b) BDT 2/kg for scanning

(c) BDT 0.25/kg/day for warehouse storage

These rates make Dhaka one of the most expensive airfreight origins in the region.

Govt steps up to upgrade HSIA

In response, the Bangladesh government is taking steps to improve logistics capacity at HSIA. Commerce ministry and civil aviation authorities have acknowledged the current limitations and are working on measures to reduce ground handling costs, streamline customs processing, and improve service quality.

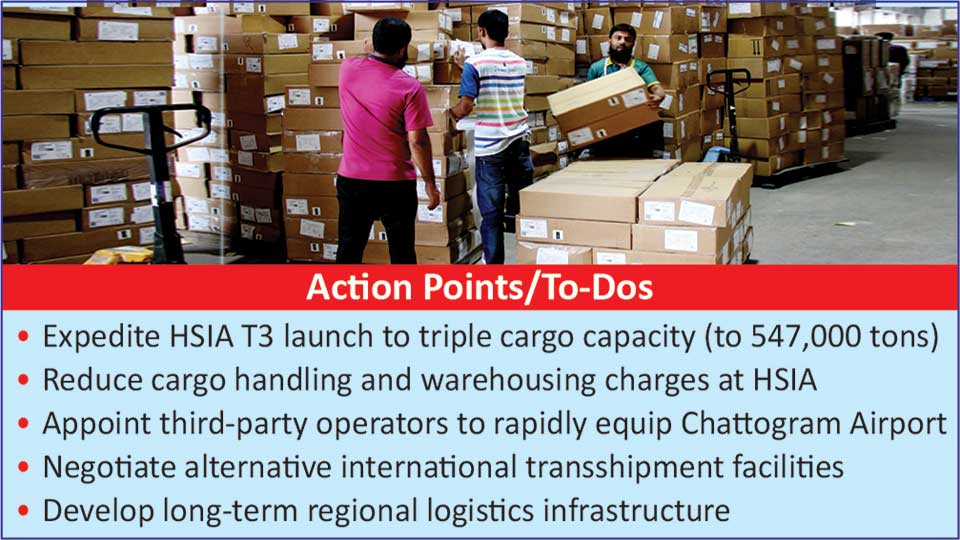

A major part of the plan is to expedite the operational launch of HSIA's Third Terminal, which will:

(1) Triple cargo handling capacity from 200,000 tons to 547,000 tons/year

(2) Introduce modern cold storage and cargo scanning systems

(3) Support a broader range of exports, including perishables like fruits, vegetables, and seafood

These improvements, once active, are expected to significantly reduce congestion and improve reliability.

Chattogram, Sylhet: alternatives with caveats

To alleviate HSIA's burden, the government is also initiating cargo operations at Chattogram and Sylhet airports.

Sylhet Osmani International Airport is expected to begin handling air cargo by the end of April, with Chattogram Shah Amanat Airport to follow.

However, both airports face substantial limitations, claimed the President of American Chamber of Commerce in Bangladesh, including lack of infrastructure, equipment, storage facility, and security.

(1) Sylhet lacks market demand: No major originating cargo is based there. Only Biman Bangladesh Airlines flies internationally from Sylhet, and even it can carry cargo from Dhaka or Chattogram-making it redundant for Sylhet to handle freight. Transporting cargo by road to Sylhet would only increase logistics costs without clear benefit.

(2) Chattogram holds promise: As an industrial hub with strong connectivity, Chattogram has the potential to become a viable cargo center. However, it currently lacks infrastructure and cargo equipment. If Biman is tasked with developing this, it may take a year.

Hence, as an immediate alternative, the government could appoint a third-party logistics company to quickly equip and operate Chatto-gram Airport for air cargo.

Exploring alternative routes

Some exporters are considering rerouting shipments via the Maldives, transporting goods by sea and then airlifting them onward. Air freight from Maldives costs between USD 3.00-USD 3.50/kg, making it cheaper than Dhaka. However, this solution presents longer lead times, added complexity, and limited scalability-making it unsuitable as a long-term fix.

What is at stake

The current disruption comes amid mounting external pressures: heightened tariffs from key markets like the US, shifting global demand, and increased scrutiny over Bangladesh's trade practices. With the RMG sector alone contributing nearly USD 36 billion in exports last fiscal year, the implications are severe.

The rise in lead times, logistics costs, and route uncertainty threatens to erode Bangladesh's competitiveness in global apparel markets. Exporters fear lost orders and dissatisfied buyers if urgent improvements are not made.

Road ahead

Key steps being urged by industry stakeholders include:

(1) Rapid launch of HSIA's Third Terminal

(2) Short-term third-party operations to equip Chattogram Airport

(3) Reevaluation of Sylhet's cargo role due to lack of demand as well as facilities

(4) Cost and process streamlining at HSIA to remain globally competitive

Over the long term, Bangladesh must prioritize building a resilient, regionally distributed logistics network. That means developing cargo capabilities in key production zones, enabling flexible routing, and reducing over-dependence on any single airport or country.

If these steps are taken decisively, Bangladesh can not only overcome the current shock but also come out stronger-with a more efficient and diversified export infrastructure, concluded stakeholders.